What’s the Best Way to Compare PEOs?

There are 700 of them – how do you even figure out the right ones to call to even narrow down the process?

This will address some of the questions, but it really brings up the other questions that you have to think about. Not exactly a checklist but really this gives you an idea of the differences in the complexities of the purchasing process. But don’t be scared – there’s an easy way to do this all – more on that later.

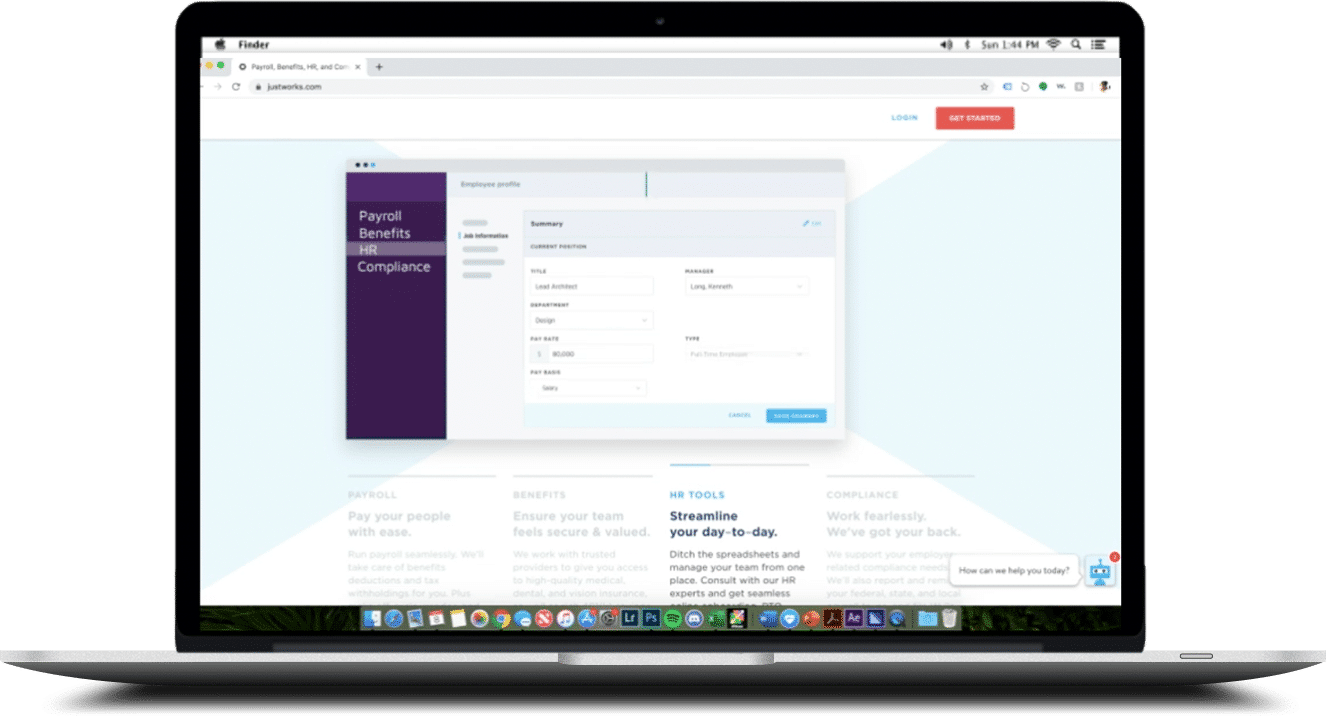

The comparison spreadsheet we use has 48 rows and they are all important. I know we have said this in other FAQs but it’s worth repeating – they sound like they (PEOs) all do everything – they will all check off they do it on your spreadsheet – just ask any direct PEO salesperson from any PEO- they will tell you how the PEO they are working for (currently) is the best – here is the short truth to this fundamental and important question – PEOs encompass so many aspects that are each complicated – from payroll to benefits to HRIS to WC, etc… even if you have one now and you think you know what to ask for it will take incredible time to do the right due diligence on them and that presumes you went to the right ones. What their salesman says, their internet reviews and their glowingly happy client referrals they cherrypick for you is not what you need to hear or internet reviews say or happy client referrals they cherry-pick for you to talk to say is not what you need – even if you had the time to do this time-consuming project, what you need is a professional that really is objective about the companies, has dealt with their problems, knows what is really going on this year with their software or organization. By the way, a PEO broker doesn’t charge a fee for all this – they get you better rates than if you went direct – you fill out fewer forms – and they will do the comparisons between them all.

Why do you need to compare? Because they are so very different from technology, from service, from guarantees, from style, from admin rates, from hidden fees, from benefit plan, and WC and benefit rates and renewals, from compliance help and defense.

What are these called? They’re called PEO brokers they don’t charge a fee they get lower rates and most importantly they’re good and that is the only thing they do and there are big differences between PEO brokers, but the most important thing is they will make sure you did not pick the wrong PEO you could get fired because of it literally.

See additional FAQs on how brokers operate:

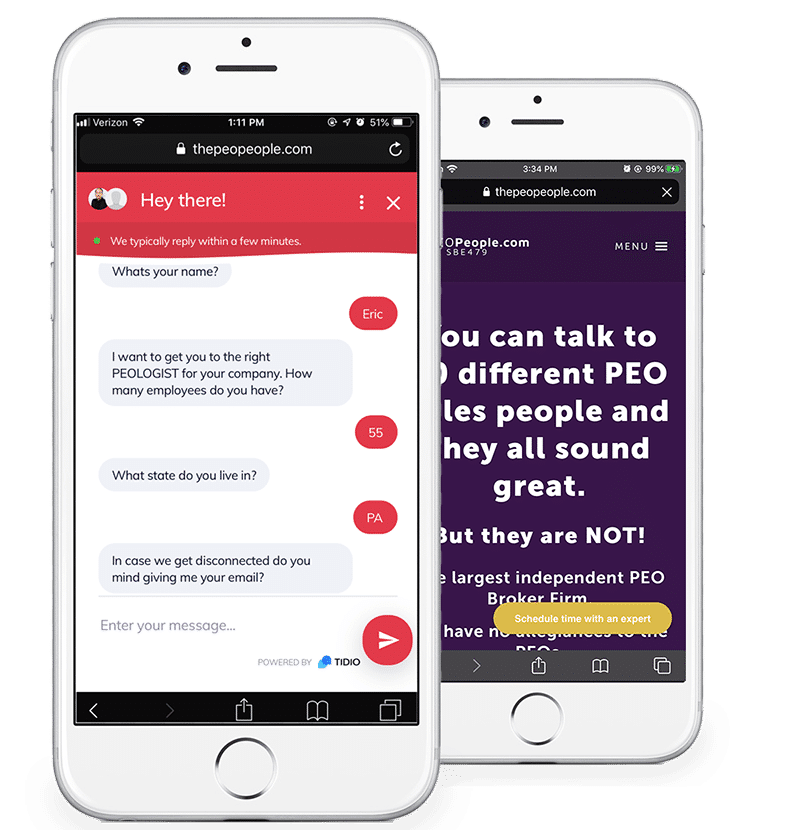

Why Do People Select ThePEOPeople.com?

Why Should I Call a PEO Broker Instead of the PEO’s Directly?