How much does a PEO really cost?

Here’s the short answer –

The total cost of the PEO is a combination of the costs of the Administration, (things like Payroll, HR, Compliance, Time and Attendance, etc), Worker’s Compensation, Medical, Unemployment, and a few other services.

Generally, when people ask about PEO costs they’re really thinking about the administrative fee, but you really have to think about the total cost and then compare it to your current expenses for the apples to apples comparison of products and services.

Some companies charge a lot for administration and very little for the insurance, while some charge the opposite. This is really why you have to look at the combined totals to compare to each other and to your current costs.

But what about Administrative fees you may ask? Well, they really have an extraordinary range – they can be anywhere from $49 per month per employee to over $150 a month. Yes, that sounds high but remember you probably save way more than that on Medical and Workers Comp and Unemployment – frankly when you see all the services and technology the good ones provide, you will why so many companies are using these PEOs.

By the way, some PEOs also charge a percentage of a payroll basis, and this is often the best pricing model for those companies with lower-paid employees. Those costs might range from 2 to 3.5% of payroll (some also charge by check).

Are there other nickel and dime fees we need to know? Here again, the answer can be yes with some – another reason you really need a professional to look at all this with you and let you know which PEO’s have fees that you may not know to even look at. E.G. – do you know what scooping costs are? A professional broker like ThePEOPeople.com will do the analysis and comparisons for you on this (as well as the other fees in the contract).

By the way, when people hear the note those numbers they often ask things like “Does that include health insurance? What about Worker’s Comp. and Unemployment?”, and the answer to that is “No”.

So do PEOs actually save you money? The answer usually yes, it really depends on what you’re spending on health insurance, participation in your plans, etc.

They generally can save you a lot of money, but it varies depending on your situation.

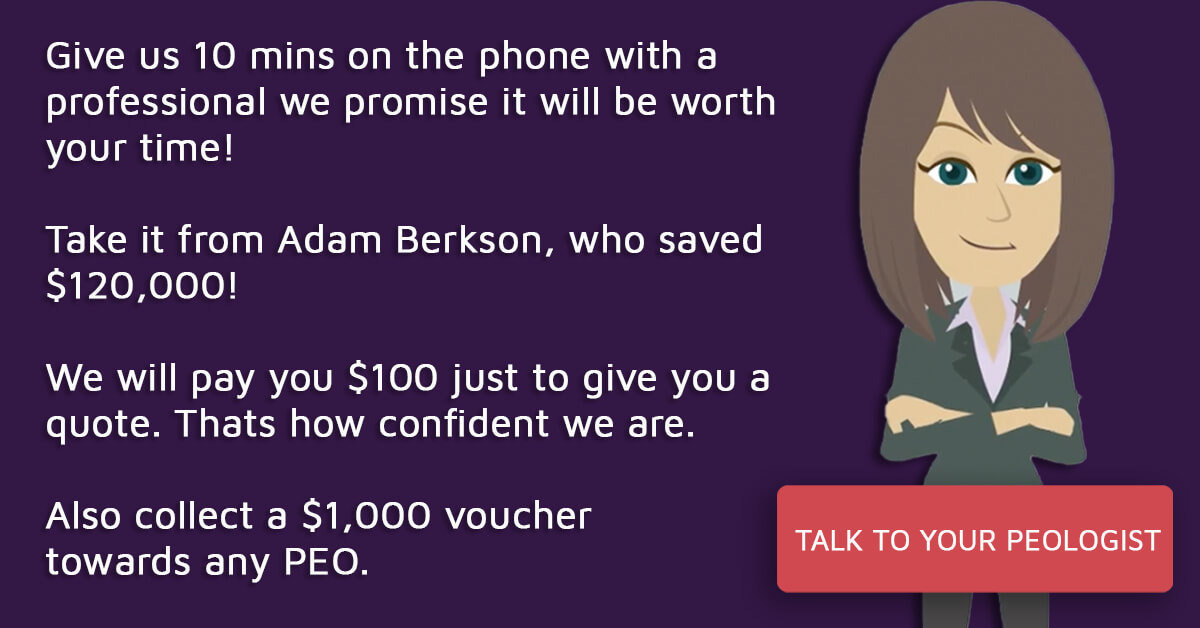

At the end of the day, the truth is you never truly know on your own, and it’s worth the effort to get quotes because sometimes it’s dramatically cheaper.

Choose an experienced PEO broker to help figure this out – they are objective, they actually save you money, and they save you from having to talk to 5 different PEO salespeople and finding the right PEO’s to compare.

What Don’t PEOs Do?

What most PEOs don’t recruit–they are not staffing operations or leasing companies.

Some will do actual employee relations, disciplinary action, etc., but most do not.

Most will do training, but it is primarily discrimination and sexual harassment. Many also will have online training classes on everything from Excel to OSHA to leadership skills in multiple languages.

Since they will be replacing your broker, do they do everything that a broker does? And the answer actually is yes– they will come out to meet your employees (at least most will) They will do some on-boarding in-person and will also most likely get your health insurance significantly a little lower cost.

Some also don’t do FMLA, overtime alerts, or time attendance with GPS paperless i9 forms. Some don’t automatically provide all the required forms automatically as part of the package where ever that employee is eligible.

Some don’t even do ACA reporting and compliance automatically.

Perhaps the most important criteria are: who has the service model you want and who has the technology that really makes it user-friendly for you and your employees? Who really does have good long-term medical and workers comp renewal’s? So, if they don’t, that is when sometimes you need an industry expert.

Think of a PEO as an HR company that also does payroll, HR technology, and all the expertise of HR. What they’re not is an insurance broker that doesn’t know anything about HR, and who doesn’t know anything about payroll.

PEOs are the iPhone of human capital with people behind them that enables you to run your company better and safer

How a PEO salesperson gets paid, and why do I care?

The average PEO salesperson makes $150,000 -$200,000 or more, and their annual quota is about 300 to 400 new employees a year. Not 300 new companies. The average employer size is 30 to 35 employees per company.

So, you can do the math how much the PEO must add on to use their expensive direct sales force. SBE479 – ThePEOpeople, bypass the local salesperson and save you all that money. Plus, we have the clout to get lower admin rates, lower set up fees, lower medical costs, and lower workmen’s comp costs. You’ll also get the modules you wouldn’t normally get!

Because that PEO salesperson is only representing a single company, they will only try to steer you toward their direction. They aren’t telling you what is inferior to their only product. Macy’s doesn’t sell Gimbels.

And once you sign on the dotted line with that salesperson, that’s usually the last you’ll see of them. They’ve got 299 more customers to sign-up….