PEO Services

We are Your New HR Bestie.

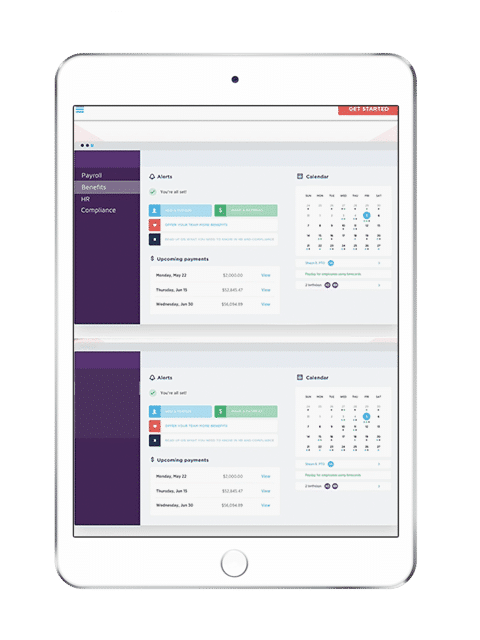

It’s 2020 – by now you should have an HRIS system that does all the annoying, time-consuming stuff that you and your employees have to do. Take a look at one example of the iPhone of Human Capital. This kind of human resources system comes with all of the Professional Employer Organization (PEO) packages we would show you, everything is included – plus even more services, including things like workers compensation insurance, payroll benefits, and lawsuit protection. Have a look then click to get a quote.

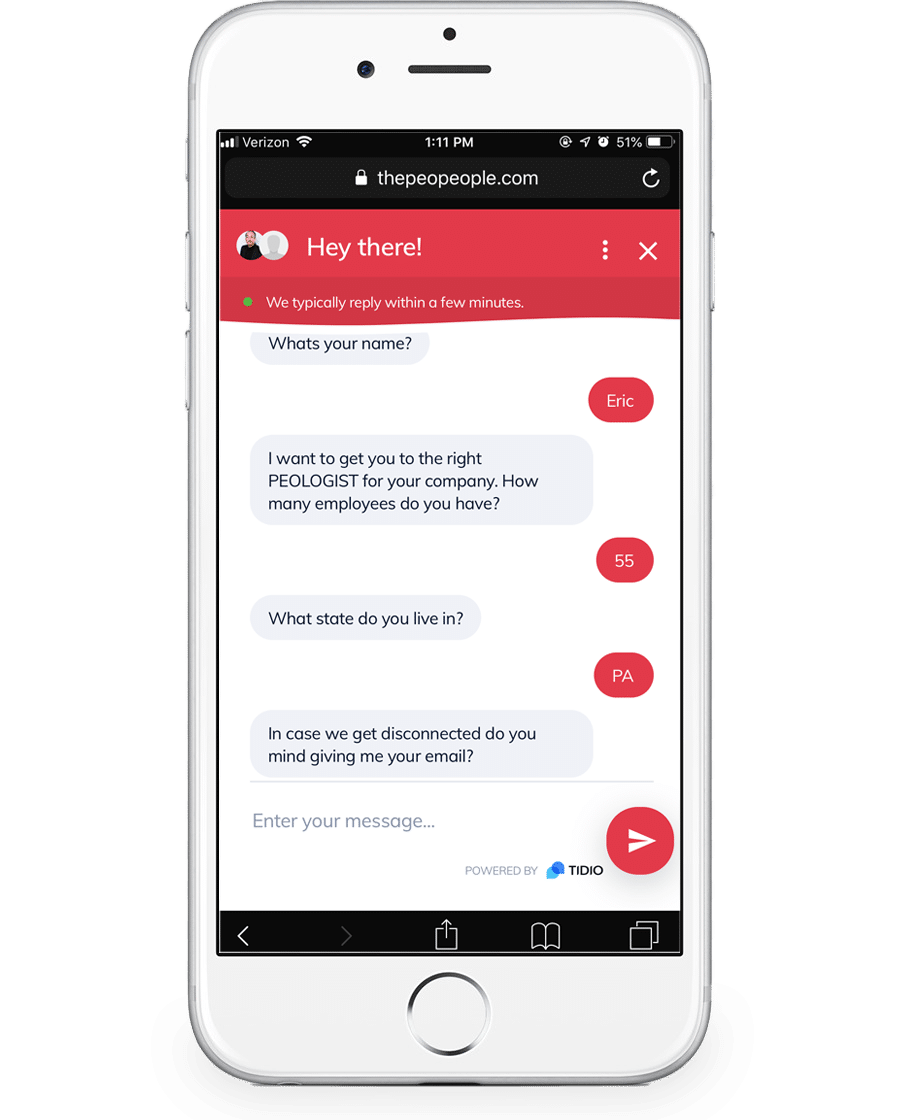

Talk to your PEO-OLOGIST

PEO Services

and examples of models below.

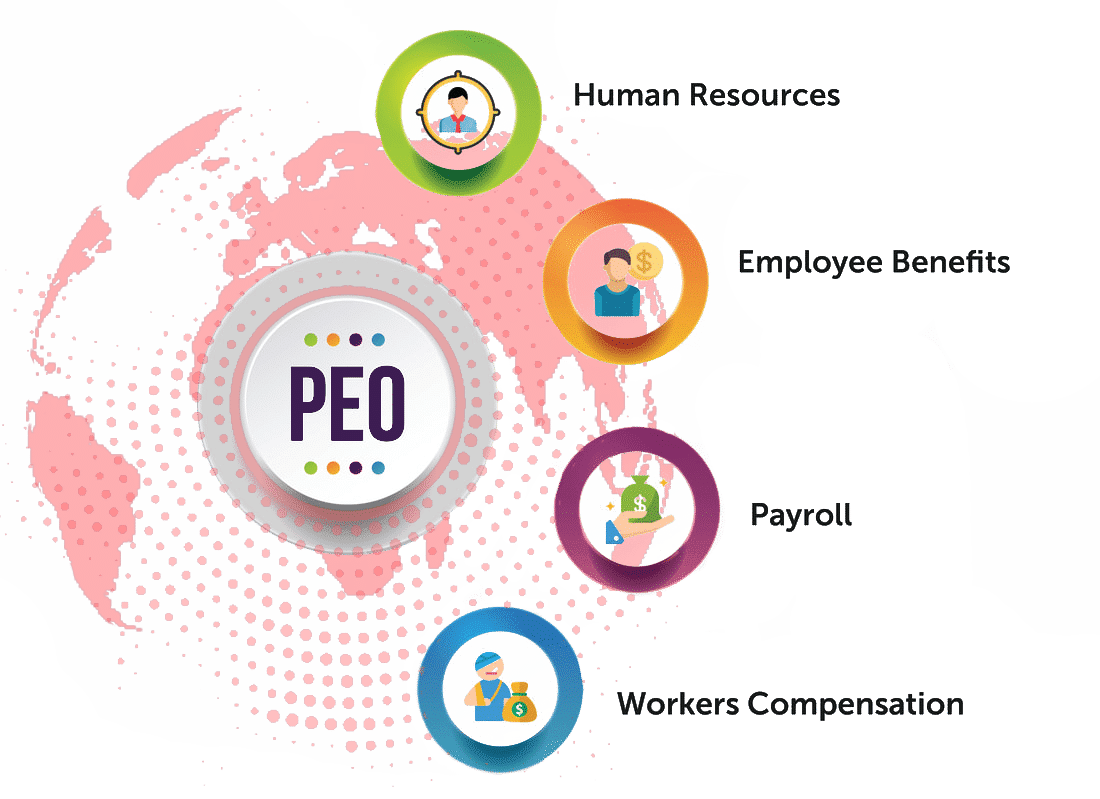

Payroll

Run payroll seamlessly.

PEO companies can take care of benefits deductions and tax withholdings for you. Make off-cycle, vendor, and contractor payments whenever you need to, at NO extra cost.

Employee Benefits

Make sure your team feels secure & valued!

Work with trusted providers to give you access to high-quality health insurance (medical, dental, and vision), as well as rich 401(k) savings plans, workers compensation insurance, and perks for your employees -ThePEOPeople.com can get you access to wholesale pricing.

Human Resources

Streamline your day‑to‑day.

No more spreadsheets! Manage your team all in one place. Consult with HR experts and get seamless online onboarding, PTO management, pre-built reports, and more with our fully-integrated HRIS.

Compliance

Work fearlessly.

Get support for your employer-related compliance needs. Report and remit your federal, state, and local payroll taxes, and file W-2s and 1099s, so tax season is a lot less stressful with a PEO Provider.

We’ve Got Clout.

Direct sales reps don’t have the buying power of a large distributor.

All of the biggest Fortune 500 companies in the world use brokers now for things like Medical, HR, and Workers’ Comp – and for a good reason. Would you hire someone who’s just painted a small shed in his backyard to paint your house, or would you rather hire a fully serviced professional painting crew? That’s the difference.

Give us 5 minutes.

We are the largest independent PEO Broker Firm. We have no allegiances to the PEO Employers. We will get you great quotes and straightforward answers. Access to our wholesale prices and the easiest shopping process.

Talk to your PEO-OLOGIST

So, what don’t PEOs do?

PEO firms don’t replace HR.

It is NOT HR outsourcing.

It will not replace you – it may get you a raise, however!

It does NOT do the most important parts of HR functions. It doesn’t do human capital management.

- It does give you the tools to help you do it better.

- It doesn’t find new people and make sure they fit your culture. It doesn’t make culture.

- It will not write the policy manuals and job descriptions with your direction.

- It doesn’t do performance management – but they have beautiful modules to do it easily, however you want to do it nationally/internationally, by location, etc.

- They do make sure you don’t overpay for overtime,

- They do give you reports to make sure you’re not out of compliance but it doesn’t fix it – that’s your job.

- They do not make sure that your employees are happy and want to stay with you – although they do control your benefit costs, which is a very big part of why and how you can hire and keep people. You will lower the employee’s contribution and also lower your cost while having better retention and acquisition of great people.

They don’t recruit, and they don’t fire employees because they are still your employees but they (the PEOs) will make sure that if you want to hire and/or fire somebody you don’t get sued, without charging $500 an hour. And if you do get sued they will cover it and defend you.

Get Fast Quotes Now

It sounds like a lot.

It sounds like PEO service companies don’t do a lot, but what they actually do enables you to do a lot more than you have done in the past:

- Better rates

- More services

- Protection from lawsuits and liabilities

- Keeps costs low and morale high

- and a variety of other key features you can only get the best of by selecting the right PEO Broker

Let us help you find a PEO here.

AND…

They also do automatic bill reconciliation among all the carriers and enable you to offer more benefit plans than you currently may be able to.

They don’t design the 401(k) but they will give you a 401(k) program where you’re not the fiduciary, and it will save you administrative and internal costs in the funds. This surprisingly adds up to a tremendous amount of money for you and your employees.

Let’s address Co-Employment

Now I guess we also need to address the word Co-Employment.

Co-employment is NOT, NOT, absolutely NOT joint employment. Co-employment is almost just a definitional phrase within the Small Business Efficiency Act #479 that enabled PEOs to include your employees in their Benefit, Worker’s Comp. and Unemployment programs.

It is defined to address only payroll tax benefit issues – and it does not mean the employees are theirs, except for payroll tax and compliance purposes. They are still your employees – and we need to repeat this because it’s often a big scary misunderstanding, your employees are still all your employees (whether you want them or not).

In fact, the plus of co-employment is the fact that the PEO is therefore liable for so many things that normally you are liable, and most do also provide E.P.L.I. at no cost – full HR liability coverage! Read more about co-employment here.

So why don’t more people use PEO service organizations? It’s simple: The current insurance broker doesn’t want to even show you them to because they don’t want to lose the commissions, and the commissions on PEOs are much less (if they even knew to consider shopping PEOs anyway). They will talk you out of it and attempt to scare you. Don’t fall into their trap – it is your job to explore this even if you love your broker (and no they shouldn’t be the ones to shop it – CLICK HERE TO SEE WHY).

Other reasons include:

Fear of changing systems and Implementation and inertia creates fear and hesitation – BUT the good news is it’s a non-issue. The PEO service providers know how to do it really easily, it is some work but it’s not as much as you would think at all. They do it all the time and know-how to make it easy.

Sometimes the administrative fees eat up the health insurance savings – this can definitely be true – it’s a matter of how much it eats up and if it’s worth it. Of course, it’s worth it if you got all this for the same price, if it’s a lot more or a little more tean that’s a question for another topic. If you get all of this and save money it’s a total win-win but the only way you know is to get a quote. This doesn’t take a lot of time if you’re working with a quality organization and Broker but going direct does take a lot of time and effort

More about Employee Leasing

Explore our FAQs

We know this process can be daunting. Don’t go at it alone. Take a close look at shopping process we explain here.

Check out our FAQs