Employee Leasing

So, what is employee leasing?

AND can a PEO (Professional · Employer · Organization) provide employee leasing services?

Employee Leasing

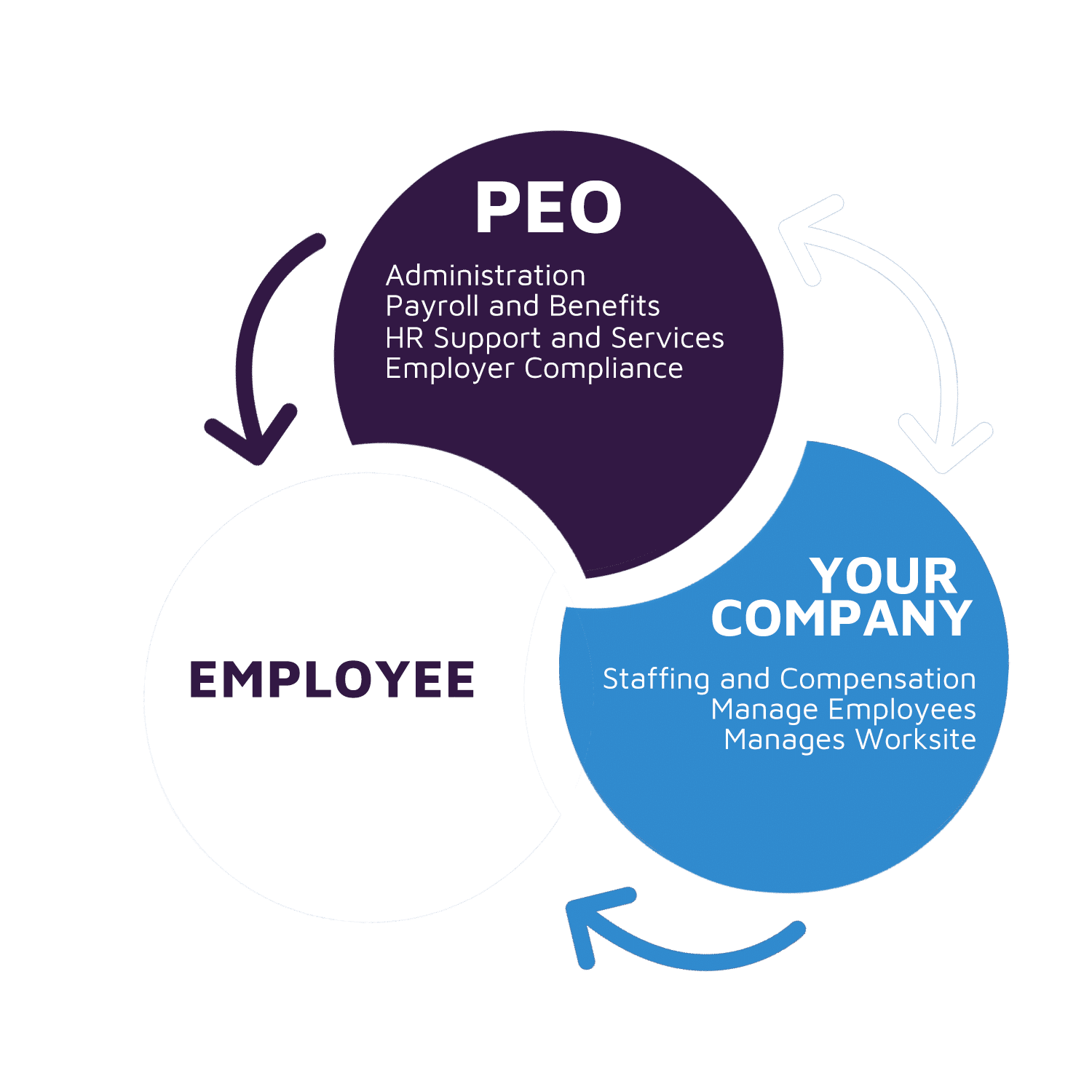

PEO, Professional Employer Organization is not an Employee Leasing Company. With PEOs, the employees are still yours and the fees are way less than leasing and staffing companies. But they kinda sound the same and both do enable clients to responsibly, and cost-effectively, offload human resource management and other employment-related tasks such as employee administration, workplace safety, compliance, unemployment and workers comp. claims, risk management, benefits, payroll & payroll tax compliance, and more.

Through this co-employment arrangement, the client and the PEO contractually share human resources and employer responsibilities and liabilities. Many people think PEO clients are just small businesses but PEO clients come in all sizes, locations, and industries, and are enabled to focus on maintaining and growing their bottom line while the PEO concentrates on what they do best: HR.

What’s the benefit of employee leasing services?

So, what is a leased employee or employee leasing?

It is a contractual arrangement in which the employee leasing company, also known as a professional employer organization (PEO), is the official employer. An employee leasing agreement allows for the responsibilities typically to be shared between the leasing company and the employer (you, in this case). You retain essential management control over the work performed by the employees.

The leasing company, meanwhile, assumes responsibility for work such as reporting wages and employment taxes. As the client your main responsibility is writing a check to the leasing company to cover the payroll, taxes, benefits and administrative fees. The PEO does the rest.

PEO employee leasing or staff leasing lets a business owner add workers without adding administrative complexity. Employee leasing firms manage compliance with state and federal regulations, payroll, unemployment insurance, W-2 forms claims processing, and other paperwork. Some also offer pension and employee assistance programs.

By combining the employees of several companies into one large pool, the leasing company can also offer business owners better rates on health-care and workers’ compensation coverage. The net effect can be significant savings of your time and money.

Now how do you decide?

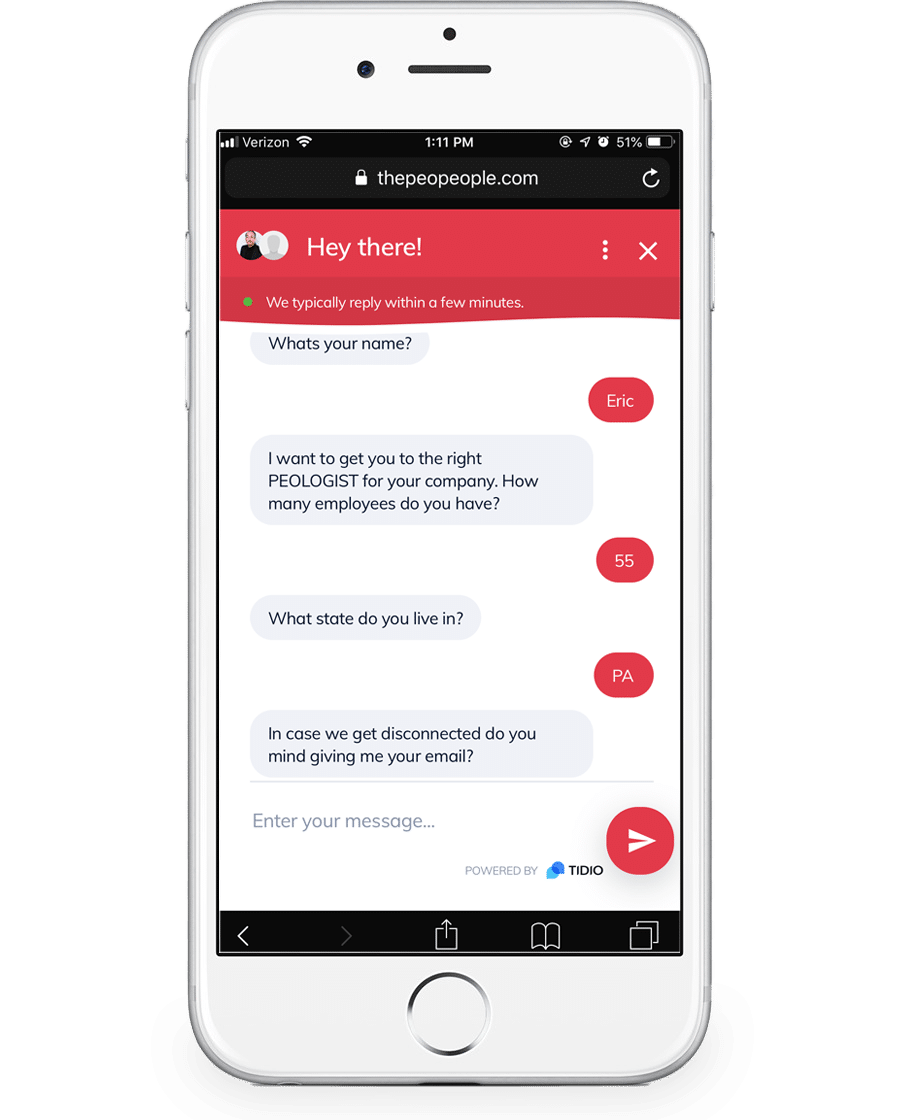

That’s where we come in! We are the largest corporate buying group. We work for you, our client, NOT the PEOs. We help you find the right fit for you and your employees. We are here to help you. Here’s how to start:

Fill out ONE universal form to give some information about your company.

Let us get you multiple fast free quotes.

Reasons why your company might not be using a PEO.

HR managers worry about being replaced.

Many HR managers fear that an SBE479 Plan (or PEO) will take away their tasks and make their jobs obsolete. The good news is, the opposite is actually true. A good SBE479 Plan empowers your HR department to run better and spend their time on more valuable aspects of your business, such as improving your recruiting and retention procedures.

Plus, there is no way your HR director can keep up with all the regulations a business faces. The constant changes are just overwhelming for a small business and can be for a business of any size. Having another company to help, and to be liable if there is a mistake, relieves business owners of a major job stressor.

Co-employment: A scary-sounding word.

SBE479 Plans can do all this because of the concept of co-employment. “Co-employment” doesn’t mean you lose control of your company or your staff – but it kind of sounds that way. Co-employment isn’t about giving anything up through some weird sleight of hand. It’s about sharing liabilities. SBE479 Plans operate based on a federal law specifically designed for them. Here’s how co-employment works:

Your business shares the E.I.N. of a large group of small companies like yours. Because of this, you bypass all the regulations about small “groups” from insurance companies. It may sound scary, like they now run your company and your employees, but the law is really clear on what this ‘sharing of tax IDs’ is about.

The best benefit regarding your employees is that if they get hurt or sue you – whether it’s a baseless lawsuit or a legitimate one – they are suing the entire EIN. Your SBE479 Plan handles this and is liable for it – so they make sure you have systems in place that protect both you and them. And if for some reason you decide you don’t like your SBE479 Plan, you can fire them.

What Industries do PEOs Serve?

Our clients include all industries ranging from white, blue, and grey collar – from technology to manufacturing, to medical, staffing, hospitality, venture capital companies, etc.

They are both large and small business organizations. Our underwriters have quality providers in every vertical and industry – in every state, and every size from 25 to 5,000 workers.

What can a PEO do for you?

Experienced PEO Help with Risk Management and Compliance.

- Access to Specialized (and Expensive) Technology.

- PEOs Help Attract and Retain Top Employees.

- Streamlined Payroll and Claims Processing.

- Improved Overall Job Morale.

- Better Benefits Packages for your Employees.

- Improved Productivity and Profitability

How Do I Find One?

Our job is to connect you with PEOs who are best suited to meet your business’s unique needs. Using the information you provide in our Universal Form, we can analyze your company’s needs and the services a PEO offers using our PEO comparison chart to find the best fit.

Schedule a quick call with a PEO-OLOGIST. Give us a little information about your company and we will go out and get multiple quotes for you. It’s our job to help you find the best fit for you and your employees.

We Get your Access to Experts

Access to experts. Make sure the PEO you partner with provides you with a designated team of experts who can handle your HR, risk management, benefits, and payroll needs. You want to partner with a company that provides specialists in each area, as well as a relationship manager who can help you use the services available to you to your full advantage.

How it all Started….

PEOs were originally staffing companies or employee leasing companies that primarily operated employee leasing services.

Sometimes PEOs were even used for recruiting to assist businesses in getting Worker’s Comp. When the state wouldn’t provide it or for highly paid doctors who wanted to get defined benefit plans and pensions for themselves but not give it to their employees.

PEO employee leasing allows you to put an end to all the headaches of employee benefits and insurance management, allowing you to scale your company, take care of your workers and get better prices for all of your employee care plans across the board.

Our Methodology

We compiled a list of almost 700 PEO services after analyzing industry trends, considering companies featured on other review sites, reviewing top industry players and searching NAPEO’s (the National Association of Professional Employer Organizations) website.

After analyzing their services, establishing whether they were national PEOs, reviewing their accreditation and NAPEO membership, and grading their online presence, we whittled the list down to the top selection’s that will best serve you and your employees.

Let us get you quotes now!