Important Covid-19 and C.O.B.R.A.

The CARES ACT may be great but

How can the A.C.A. also help you?

Stuff you don’t see elsewhere

You will be laying off people and many of them will be staying on your health insurance under C.O.B.R.A. – thank goodness for C.O.B.R.A.

However, there are now better options for coverage from both your employees and from your point of view.

You’re, temporarily, ex-employees can go on what we all still refer to as ACA/Obamacare plans.

The plans will likely not be as good as what you offered and depending on their age and your current health insurance premium the individual Obamacare plans may be more or less expensive than your coverage, but that is not the actual net cost to the (tempx) employees – and that is because of the massive federal subsidy’s employees and their families receive under Obamacare still – and it applies to 70% of all your employees.

Below is the best site to see this in action.

It is really important you look at this especially now.

These subsidies sometimes pay for almost all the insurance premiums, literally.

At the very least the Act does make insurance affordable and no more important a time than now (yes that was the A in ACA).

Here’s a link that you can pass on- but PLEASE look at it yourself to see how dramatic these federal subsidies are.

If you have under 50 employees and because you are a generous and smart employer and you provided health insurance when you were not required to and/or if you have over 50 employees (that is not to say you were not a generous employer) – your employees could get individual health insurance on the open market directly, but were precluded from getting the government subsidy’s. Now they can after being furloughed even temporarily.

It is not only in their interest, but it’s in your interest to make your employees aware of this for two reasons:

- It helps your relationship with your employees so when you hire them back, they will appreciate your help.

- The second reason is selfish, in a way, because it is generally those people that take COBRA that is higher risks and their claims will end up increasing your renewals for everybody in your group.

There are certainly questions about the subsidies because the actual Obamacare ACA subsidies are based on expected annual income (which nobody knows), but unless you want to keep paying their health insurance – every person you furlough will be in dire straits and it’s all of our collective jobs to help each other and this can good for so many of your “employees”.

By the way – the subsidies really shine in getting lower paid family’s medical coverages they can afford.

For additional information on COVID-19 such as legal exposure questions, and things you don’t hear in the other thousand emails you’ve received. Click for our blog.

By the way, PEOs deal with all this for you – so next time you shop coverages let us get you a quote because COVID-19 is not stopping your renewals and fear it will increase medical rates an additional 7% more than they would have been. Ahhh…

It is important to note that the Kaiser Subsidized Calculator is predictive but it is not totally accurate because of the employee’s age, state, and other factors factor into that individual’s benefit – so they actually need to go to their local insurance carriers to get the exact subsidy and plan options. Please advise them to be pretty careful doing this because most of the links for health insurance are con jobs by insurance agents looking for leads and they will drive you and your employees crazy – tell them to go only to the carriers directly or the state program.

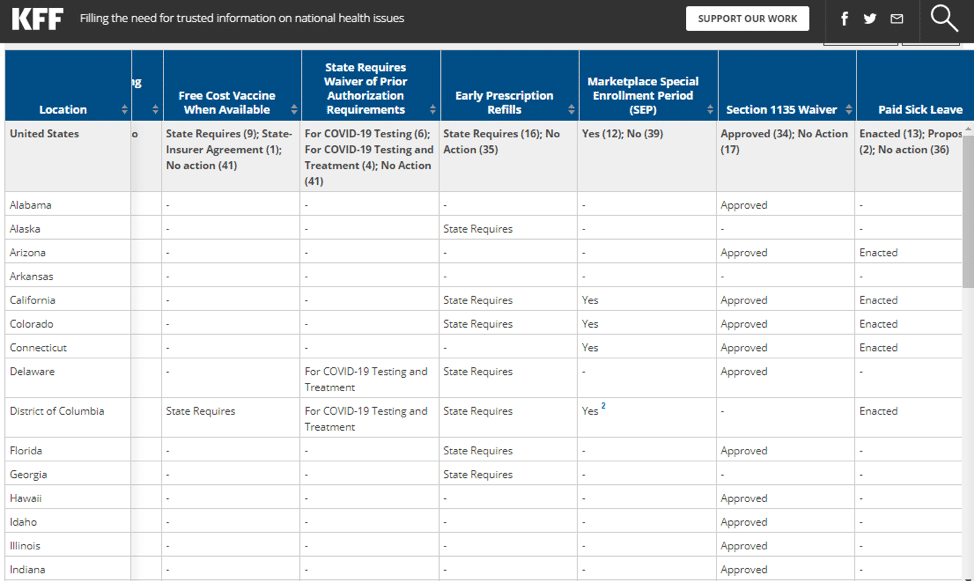

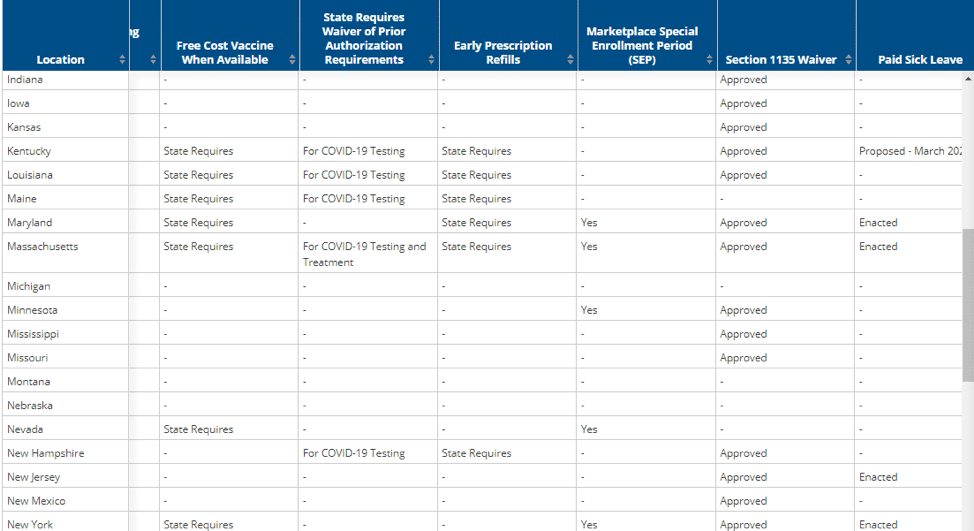

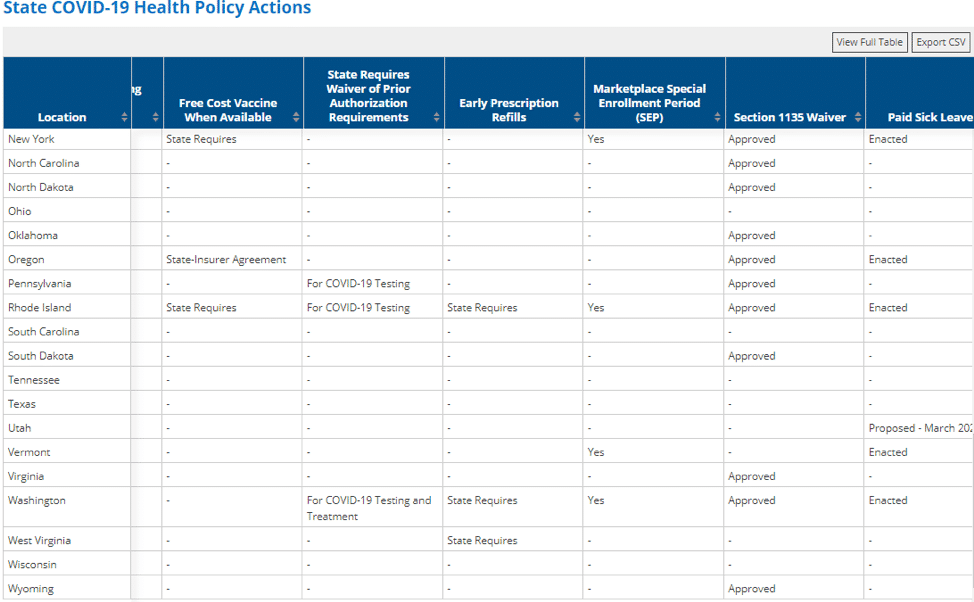

Below is directly from the Kaiser site

The ACA established Marketplaces where people not eligible for job-based benefits or Medicaid can buy private coverage with financial assistance. Citizens and documented immigrants can buy health insurance through the Marketplace.

For consumers: In most states, the Marketplace website is www.healthcare.gov. Anyone can buy coverage during Open Enrollment. During the COVID-19 outbreak, 12 states (as of 3/30) have created a special open enrollment period when anyone can buy Marketplace plans.

People who lose other coverage are eligible for a special enrollment period (SEP) in the Marketplace. If you anticipate coverage loss, you can apply for a SEP up to 60 days in advance. Otherwise, you have 60 days following the loss of coverage to apply. Healthcare.gov will ask for documentation of coverage loss before you can apply. If you applied in advance, coverage could start under your new plan as the old coverage ends; otherwise, it starts the first day of the month after you complete your application.

The Marketplace offers premium subsidies to those who expect 2020 income will be 100% – 400% FPL: $12,490-$49,960/individual and $25,750 – $103,000/family of 4.

This subsidy calculator can give you an idea of what you might have to pay. You will have to provide your best estimate of your 2020 income when you apply (don’t forget unemployment benefits), and if your income changed substantially in the last year, you may be asked to submit additional documentation. You can lose subsidies if you don’t submit that documentation on time.

Marketplace plans have high deductibles, though cost-sharing subsidies are available to people with income 100% – 250% FPL. Most plans use narrow provider networks, so you may need to change doctors.

For policymakers: An estimated 9.2 million uninsured Americans were eligible for Marketplace subsidies in 2018 but not enrolled. Even with subsidies, the average person paid $87/month after tax credits and some paid much more. Various bills have been proposed to enhance Marketplace subsidies and make more people eligible. Meanwhile, the Administration has the authority to relax the up-front documentation required of applicants whose income has changed substantially. Everyone is still required to reconcile subsidy eligibility at year-end on their federal tax return.

as of 3/30/20 these are results you will find on the Kaiser site.

| Other COVID-19 related Health Insurance Questions You Need to Ask Yourself! |

| Q: Can employer groups keep furloughed employees or employees with reduce work hours on their group coverage? Q: If an employer group’s enrollment drops due to COVID-19, will the group be re-pooled or re-rated? Q: Is there a time limit for how long a furloughed employee can remain on the plan?. Q: What happens if an employer extends coverage during the layoff? Will allow them to come back on the plan without having to meet the eligibility-waiting period? If so, how long could one be laid off and not have to meet the waiting period? |

ThePEOpeople.com wishes you the best and you can always call us at (888)8THEPEO

(yes, you don’t have to search like crazy to find our phone number on our website).

Or click here to set up a quick meeting.

By the way here are two sites that really excellent re COVID-19 Updates – one very visual one very to the point.

Read more about the COVID-19 Stimulus Package here.