6 Advantages of a PEO during COVID-19

- Don’t Get Sued

What are your liabilities and what written policies do you need so you don’t get sued…

Examples of this – Furloughs and COBRA, Paid Sick Leave eligibility and additional tax credit entitlement?

- What Notices need to go out so you don’t get sued – e.g. conversion of group life insurance and 10 others we all forget?

- Who is eligible for benefits?

- Tracking insurance credits?

- Tax credits and creating the reports you need to file for PPP etc.?

- Helping to file for you and your employees re: unemployment claims.

- Dealing with Workers Comp issues!

PEOs work alongside organizations to implement processes that assist in keeping the business compliant – They have the people and data and the actual liability to do this for you and protect you.

2. PEOs help with Paycheck Protection Program (PPP) loans through the CARES Act

Lenders are asking for historical payroll data and tax reports quickly produced by a PEO’s HRIS System. Many small businesses without HR help find these systems financially draining. Example: Needed 940/941 reporting is issued which can be sent to SBA Lender. Also, several leading PEO’s have supported clients with NYS Shared Loans Program.

3 . Buying Group Power Creates Affordable and Better Benefits

By joining a large group risk-pool a PEO can help employers gain access to high quality employee benefits, such as health insurance options with stable and affordable rates. Due to costs, small businesses often find high-quality employee benefits out of reach. Savings for the same plan and sometimes even the same insurance company can be up to 28% over your current plans with your broker. By way – why is it they your broker hasn’t shown you PEO quotes before (answer: they get paid much less then they do from your current carrier!)

4. Payroll Burden

Payroll administration is now a nightmare. Tracking the FFCRA emergency sick leave and expanded FMLA separately from regular sick and FMLA leave has thrown a wrench in many payroll processors’ systems. Add on any furloughed or terminated employee reporting and tracking, and now the job has doubled.

Instead, some PEOs allow Clients to spend their time on mission-critical work that could make or break the business. Additionally, your payroll is processed by professionals who have the time and expertise to know the nuances of payroll and payroll tax laws with back up teams of professionals in place.

5 . Staffing Needs – On-Boarding and Terminations

A minimum 75% of PPP loans must be spent on staffing costs (as of today at least). Companies that had previously furloughed or terminated employees find they need to hire employees back. This comes with additional paperwork and many employee questions, such as whether benefits wait periods start over.

Conversely, when businesses do need to furlough or terminate employees, the PEO is a great guide for compliance. The layoff process, COBRA, paperwork including government reporting are supported.

6. HR Excellence

In General, a PEO is much like gaining access to a full-service HR division, with a team of HR experts who are up-to-date with new and changing employment laws and able to identify ways to streamline your HR.

According to a report conducted by the National Association of Professional Employer Organizations (NAPEO), PEOs provide access to more HR services at a cost that is close to $450 lower per employee, compared to companies that manage their HR services in-house.

Studies show that businesses in a PEO arrangement grow 7-9 percent faster, have 10-14 percent lower turnover, and are 50 percent less likely to go out of business and save up to 28% on their Group Health Insurance.

Summary – the time right to look into these PEOs

Like many industries we now know – some have been almost built for today’s environment and are needed more than ever before – such as Zoom for Stay at Home,

Instacart – (overpriced but good to have sometimes) etc…

PEOs are that for HR – they deal with this, protect you, and Save you a ton of money over your current carrier and broker.

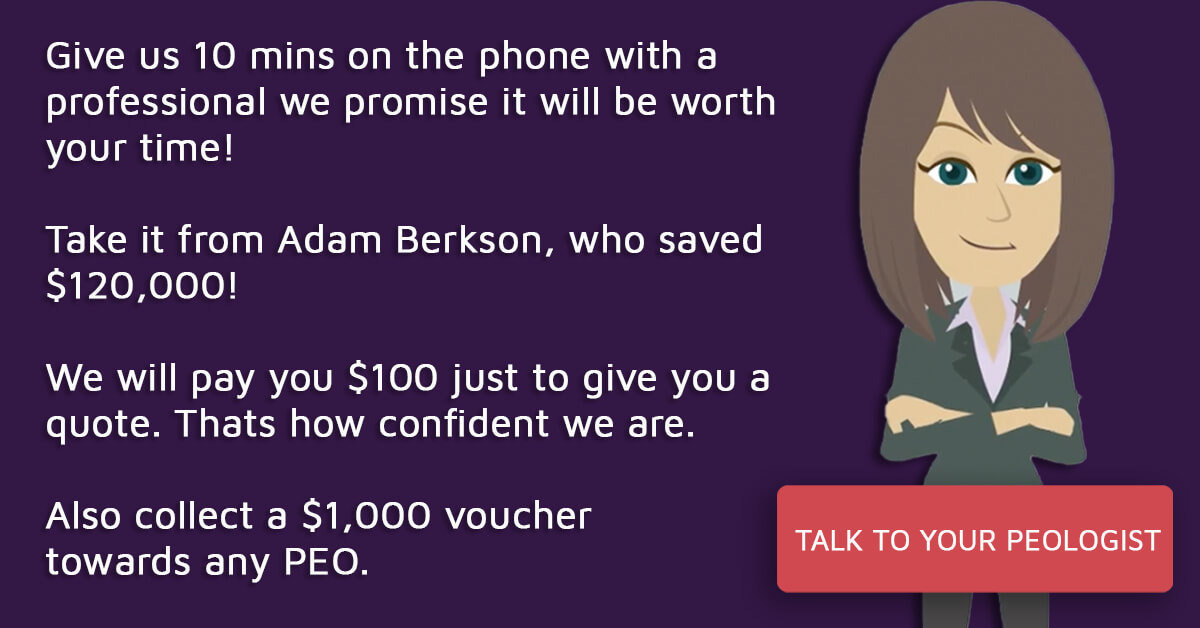

Want to hear more and get a quick quote? Click here!